2:37 | Transcript

Dr. Alexandra Arrington, co-founder and executive director of our 20th Purple Paladin, Money Magnets Club, had a natural inclination for entrepreneurship from a young age. But despite her energy, her ideas, her propensity to learn and the sage financial literacy lessons she learned from her mother and grandmother, her dreams to become an entrepreneur felt out of reach in large part because she was never taught the foundations of entrepreneurship.

“As a young, entrepreneurially inclined individual, I couldn’t find any adults who could teach me the basics of what it meant to own or operate a business, or pathways to get there,” Arrington shared. Eventually, through her own research and experiences, she started her first business. But with early exposure to mentorship and business financial literacy, her journey to entrepreneurship would have been a lot easier.

Determined to do what she could to create a different future for the next generation, Arrington set out to build a foundation of knowledge regarding financial management and entrepreneurship for kids in ways she didn’t have growing up. And she found that youth in her city of Charlotte, North Carolina needed her support more than ever — a Harvard University study identified west Charlotte as the least likely of 50 major metropolitan cities for children to rise out of poverty as adults.

“I saw how much learning about finances and practicing entrepreneurship revolutionized the way I approached work, the value of time and money, and my financial stability later in life — and how it can help those from low-income backgrounds create a new future for themselves,” she said. “All children deserve those opportunities, and that starts with learning.”

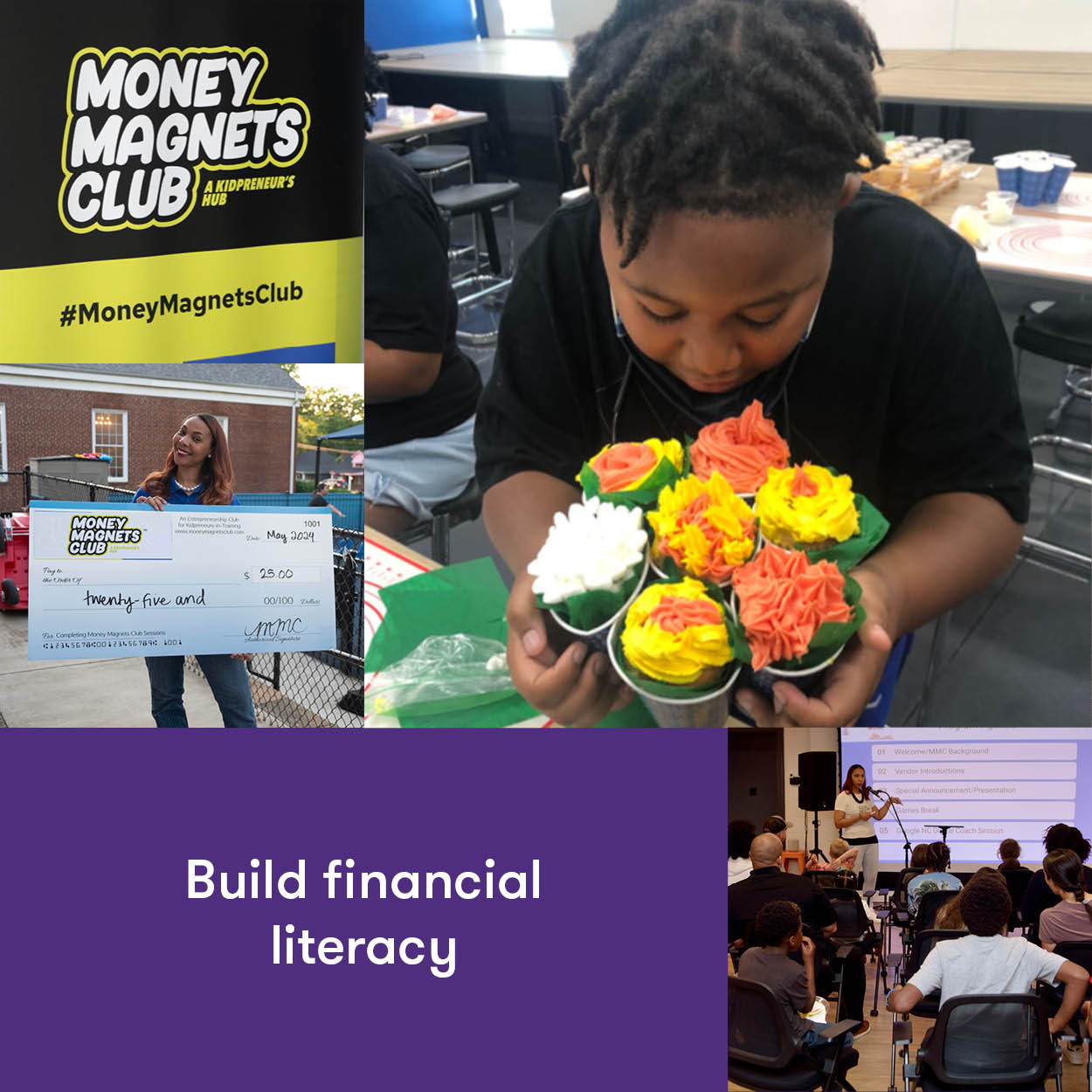

Established as a nonprofit organization in 2022, Money Magnets Club encourages financial literacy and entrepreneurship among elementary school kids and their families through education, exposure and resources. Collaborating with community organizations, schools and financial services institutions, Money Magnets Club goes to areas where it’s needed most, teaching kids financial literacy skills in developmentally and culturally appropriate ways.

“In our industry, we know how important it is to have financial literacy skills at work and in life — and the earlier kids learn those skills, the better,” said Seth Siegel, CEO of Grant Thornton Advisors LLC. “We're proud to support Money Magnets Club’s efforts to bring developmentally appropriate and culturally responsive financial education and entrepreneurship programs to kids, helping build more stable futures for families and communities.”

In Money Magnets Club’s signature six-session “Kidpreneur-in-training” program, kids learn competencies around money, budgeting and different types of entrepreneurship. The program starts by learning about the kids themselves — who they are, what they enjoy and what they might need to do to turn their interests into business opportunities.

At the end of the program, kids develop and pitch their very own business idea. And while their ideas cover a wide range of ventures — from dog walking to an all-encompassing “birthday shop” — Arrington said one of the most important things they build is confidence.

“Our goal is to not only teach kids the financial and entrepreneurial skills that will help them build their own pathways to success,” Arrington said, “but also for them to become comfortable with their voice and confident in their potential.”

Through its unique approach to teaching financial literacy skills to youth, Money Magnets Club is building more secure futures for children, their families and the cities they live in. You can help families in Charlotte and beyond transform their lives and their communities through financial literacy and entrepreneurial empowerment.